|

Council Annual Plan

27 June 2023

|

|

|

3. Annual

Plan 2023/24

|

|

Reference / Te Tohutoro:

|

23/469000

|

|

Report of / Te Pou Matua:

|

Peter

Ryan, Head of Corporate Planning and Performance, (Peter.Ryan@ccc.govt.nz)

|

|

General Manager / Pouwhakarae:

|

Lynn

McClelland, Assistant Chief Executive Strategic Policy and Performance

(lynn.mcclelland@ccc.govt.nz)

|

1. Nature of Decision or Issue and Report Origin

1.1 The purpose of this report is to present to Council for

consideration and adoption:

- an analysis of the submissions and hearings made through the Annual Plan

consultation process;

- the outcome of the Council’s considerations to date; and

- Mayor’s Recommendations for consideration before the Council adopts the

Annual Plan 2023/24, and

- the Annual Plan 2023/24, including any attached documents.

1.2 The Council is required to prepare and adopt an Annual Plan

for each financial year (s.95(1)) Local Government Act 2002).

The purpose of the plan is to:

- contain the annual budget and funding impact statement for 2023/24;

- identify any variation from the financial statements and funding impact

statement in the Council’s Long Term Plan for 2023/24;

- provide integrated decision-making and co-ordination of the Council’s

resources; and contribute to the accountability of the Council to the

community.

1.3 The

decisions in this report are of low significance in relation to the

Christchurch City Council’s Significance and Engagement Policy.

2. Officer Recommendations Ngā

Tūtohu

That the Council

Annual Plan:

1. Receives the information included in this

report and attachments;

2. Notes the recommendations of the

Council’s Audit and Risk Management Committee at its meeting on 20 June

2023, that an appropriate process has been followed in the preparation of the

information that provides the basis for this Annual Plan 2023/24;

3. Adopts the Mayor’s Recommendations set

out in Attachment A;

4. Adopts the summary of the financial, rates,

and benchmark impacts including proposed operational changes for 2023/24 set

out in Attachment B;

5. Adopts the proposed changes to the

Council’s capital programme for 2023/24 set out in Attachment C;

6. Adopts the proposed Funding Impact Statement

– Rating Information set out in Attachment D.

7. Notes the Thematic Analysis of the Annual Plan

2023/24 Submissions, set out in Attachment E;

8. Notes the Annual Plan 2023/24 - Management

Sign-off for Process set out in Attachment F; and

9. Notes the Annual Plan 2023/24 - Management

Sign-off for Significant Forecasting Assumptions set out in Attachment G.

10. Adopts the Annual Plan 2023/24 comprising the

information and underlying documents adopted by the Council at the meeting

dated 28 February 2023 (the draft Annual Plan 2023/24), as amended by

resolutions 3-6 above and Attachments B-D.

11. Authorises the General Manager Resources/Chief

Financial Officer to make the amendments required to ensure the published 2023/24

Annual Plan aligns with the Council’s resolutions of 27 June 2023 and to

make any other non-material changes that may be required;

12. Authorises the General Manager Resources/Chief

Financial Officer to borrow, in accordance with the Liability Management

Policy, sufficient funds to enable the Council to meet its funding requirements

as set out in the 2023/24 Annual Plan.

13. Having set out rates information in the

Funding Impact Statement – Rating Information contained in the Annual

Plan 2023/24 (adopted as Attachment D by the above resolutions),

resolves to set the following rates under the Local Government (Rating) Act

2002 for the 2023-24 financial year, commencing on 1 July 2023 and ending on 30

June 2024 (all statutory references are to the Local Government (Rating) Act

2002).

a. a uniform

annual general charge under section 15(1)(b) of $153.00 (incl. GST) per

separately used or inhabited part of a rating unit;

b. a general

rate under sections 13(2)(b) and 14 set differentially based on property

type, as follows:

|

Differential

Category

|

Basis for

Liability

|

Rate Factor

(incl. GST) (cents/$ of capital value)

|

|

Standard

|

Capital

Value

|

0.211685

|

|

Business

|

Capital

Value

|

0.469940

|

|

Remote

Rural

|

Capital

Value

|

0.158763

|

|

City Vacant

|

Capital

Value

|

0.957449

|

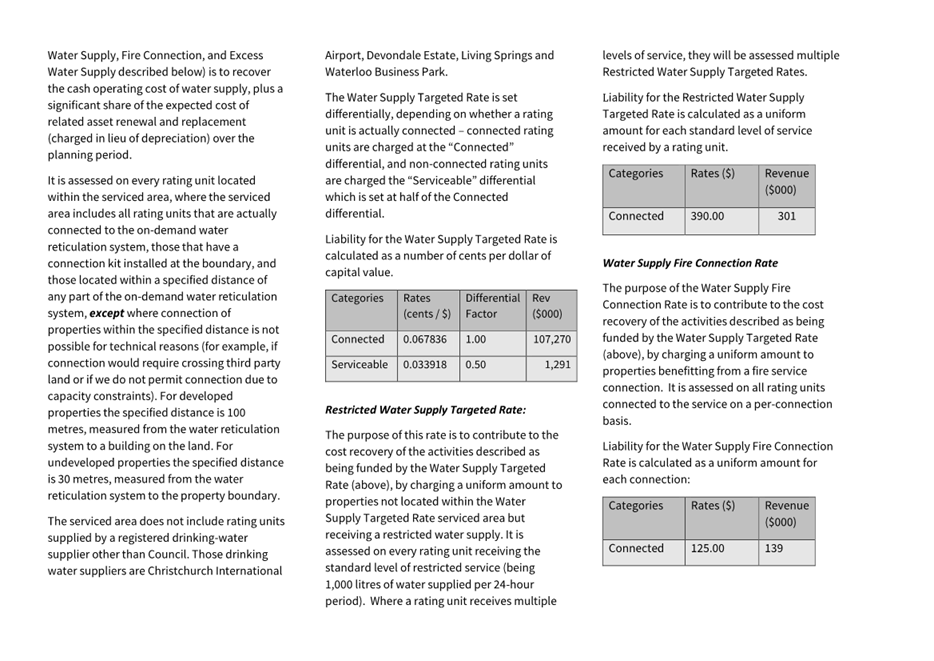

c. a water

supply targeted rate under section 16(3)(b) and 16(4)(b) set differentially

depending on whether a property is connected or capable of connection to the

on-demand water reticulation system, as follows:

|

Differential

Category

|

Basis for

Liability

|

Rate Factor

(incl. GST) (cents/$ of capital value)

|

|

Connected

(full charge)

|

Capital

Value

|

0.067836

|

|

Serviceable

(half charge)

|

Capital

Value

|

0.033918

|

d. a restricted

water supply targeted rate under sections 16(3)(b) and 16(4)(a) on all

rating units with one or more connections to restricted water supply systems of

$390.00 (incl. GST)

for each standard level of service received by a rating unit;

e. a land

drainage targeted rate under sections 16(3)(b) and 16(4)(a) on all rating

units in the serviced area of 0.035731 cents per dollar of capital value (incl.

GST);

f. a sewerage

targeted rate under sections 16(3)(b) and 16(4)(a) on all rating units in

the serviced area of 0.075347 cents per dollar of capital value (incl. GST);

g. a waste

minimisation targeted rate under sections 16(3)(b) and 16(4)(b) set

differentially depending on whether a full or partial service is provided, as

follows:

|

Differential

Category

|

Basis for Liability

|

Rate Charge

(incl. GST)

|

|

Full

service

|

Per separately used or

inhabited part of a rating unit

|

$184.75

|

|

Partial

service

|

Per separately used or

inhabited part of a rating unit

|

$138.56

|

Note:

The full service charge is assessed on every separately used or inhabited part

of a rating unit in the serviced area. The partial service charge is assessed

on every separately used or inhabited part of a rating unit outside the

kerbside collection area, where a limited depot collection service is available

(75% of the full rate).

h. a water

supply fire connection targeted rate under sections 16(3)(b)

and 16(4)(a) on all rating units receiving the benefit of a water supply fire

connection of $125.00 (incl. GST) per connection;

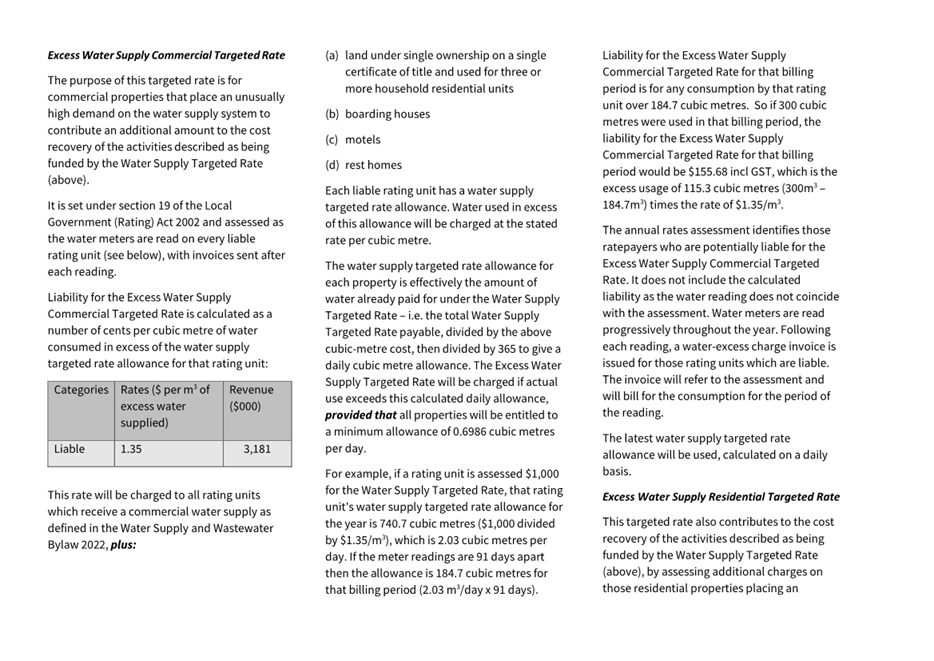

i. an excess

water supply commercial volumetric targeted rate under section 19(2)(a) set

for all rating units which receive a commercial water supply as defined in the

Water Supply and Wastewater Bylaw 2022, plus land under single

ownership on a single certificate of title and used for three or more household

residential units, boarding houses, motels, and rest homes of $1.35 (incl. GST)

per m3 or any part of a m3

for

consumption in excess of the rating unit’s water supply targeted rate

allowance, provided that all properties will be entitled to a

minimum consumption of 0.6986 cubic metres per day.

The rating

unit’s water supply targeted rate allowance in m3 per year is

the volume of water equal to the assessed water supply targeted rate divided by

$1.35.

For example, if a rating

unit is assessed $1,000 for the water supply targeted rate, that rating unit's water

supply targeted rate allowance for the year is 740.7m3 ($1000

divided by $1.35/m3), which is 2.03 m3/day. Liability for

the excess water supply commercial volumetric targeted rate is for any

consumption in excess of that allocation.

j. an excess

water supply residential volumetric targeted rate under section

19(2)(a) set for the following:

· all metered

residential rating units where the meter records usage for a single rating

unit;

· a rating unit

where the meter records usage for multiple rating units, and where there is a

special agreement in force specifying which rating unit / ratepayer is

responsible for payment,

of $1.35 (incl GST) per m3 or any part of a m3

for consumption in excess of 900 litres per day;

k. an active

travel targeted rate under section 16(3)(a) and 16(4)(a) of $20.00 (incl.

GST) per separately used or inhabited part of a rating unit;

l. a heritage

targeted rate under section 16(3)(a) and 16(4)(a) on

all rating units of 0.001886 cents per dollar of capital value (incl. GST);

m. a special

heritage (Cathedral) targeted rate under section 16(3)(a) and 16(4)(a) of

$6.52 (incl. GST) per separately used or inhabited part of a rating unit;

n. a special

heritage (Arts Centre) targeted rate under section 16(3)(a) and

16(4)(a) of 0.000416 cents per dollar of capital value (incl. GST);

o. a Central

City Business Association targeted rate under section 16(3)(b) and 16(4)(a)

of $392.36 (incl. GST) per business rating unit in the Central City Business

Association Area, where the land value of the rating unit is greater than or

equal to $90,000;

14. Notes that business differential on the

value-based general rate has changed from 1.697 in 2022/23 to 2.22 in 2023/24.

Similarly, the City Vacant differential has increased from 4 in 2022/23 to

4.523 in 2023/24.

15. Resolves that all rates except the excess water supply commercial volumetric

targeted rate, and the excess water supply residential volumetric targeted

rate, are due in four

instalments, and set the following due dates for payment:

|

Instalment

|

1

|

2

|

3

|

4

|

|

Area 1

|

15 August

2023

|

15 November

2023

|

15 February

2024

|

15 May 2024

|

|

Area 2

|

15

September 2023

|

15 December

2023

|

15 March

2024

|

15 June

2024

|

|

Area 3

|

31 August

2023

|

30 November

2023

|

28 February

2024

|

31 May 2024

|

Where

the Instalment Areas are defined geographically in the Map and Table as

follows:

|

Area 1

|

Area 2

|

Area 3

|

|

Includes generally the

Central City and the suburbs of St Albans, Merivale, Mairehau, Papanui,

Riccarton, Addington, Spreydon, Sydenham, Beckenham, Opawa and Banks

Peninsula.

|

Includes generally the

suburbs of Shirley, New Brighton, Linwood, Woolston, Mt Pleasant, Sumner,

Cashmere and Heathcote.

|

Includes generally the

suburbs of Belfast, Redwood, Parklands, Harewood, Avonhead, Bishopdale, Ilam,

Fendalton, Hornby, Templeton and Halswell.

|

16. Resolves that excess water supply commercial

volumetric targeted rates, and excess water supply residential volumetric

targeted rates are due for payment on the dates shown below in the “Due

date” column, based on the week in which amounts are invoiced (shown in

the “Week beginning” column). The “Penalty date” column

will be referred to further below:

|

Week beginning

|

Due date

|

Penalty date

|

|

3/07/2023

|

31/08/2023

|

5/09/2023

|

|

10/07/2023

|

7/09/2023

|

12/09/2023

|

|

17/07/2023

|

14/09/2023

|

19/09/2023

|

|

24/07/2023

|

21/09/2023

|

26/09/2023

|

|

31/07/2023

|

28/09/2023

|

3/10/2023

|

|

7/08/2023

|

5/10/2023

|

10/10/2023

|

|

14/08/2023

|

12/10/2023

|

17/10/2023

|

|

21/08/2023

|

19/10/2023

|

24/10/2023

|

|

28/08/2023

|

26/10/2023

|

31/10/2023

|

|

4/09/2023

|

2/11/2023

|

7/11/2023

|

|

11/09/2023

|

9/11/2023

|

14/11/2023

|

|

18/09/2023

|

16/11/2023

|

21/11/2023

|

|

25/09/2023

|

23/11/2023

|

28/11/2023

|

|

2/10/2023

|

30/11/2023

|

5/12/2023

|

|

9/10/2023

|

7/12/2023

|

12/12/2023

|

|

16/10/2023

|

14/12/2023

|

19/12/2023

|

|

23/10/2023

|

21/12/2023

|

26/12/2023

|

|

30/10/2023

|

28/12/2023

|

2/01/2024

|

|

6/11/2023

|

4/01/2024

|

9/01/2024

|

|

13/11/2023

|

11/01/2024

|

16/01/2024

|

|

20/11/2023

|

18/01/2024

|

23/01/2024

|

|

27/11/2023

|

25/01/2024

|

30/01/2024

|

|

4/12/2023

|

1/02/2024

|

6/02/2024

|

|

11/12/2023

|

8/02/2024

|

13/02/2024

|

|

18/12/2023

|

15/02/2024

|

20/02/2024

|

|

25/12/2023

|

22/02/2024

|

27/02/2024

|

|

1/01/2024

|

29/02/2024

|

5/03/2024

|

|

8/01/2024

|

7/03/2024

|

12/03/2024

|

|

15/01/2024

|

14/03/2024

|

19/03/2024

|

|

22/01/2024

|

21/03/2024

|

26/03/2024

|

|

29/01/2024

|

28/03/2024

|

2/04/2024

|

|

5/02/2024

|

4/04/2024

|

9/04/2024

|

|

12/02/2024

|

11/04/2024

|

16/04/2024

|

|

19/02/2024

|

18/04/2024

|

23/04/2024

|

|

26/02/2024

|

25/04/2024

|

30/04/2024

|

|

4/03/2024

|

2/05/2024

|

7/05/2024

|

|

11/03/2024

|

9/05/2024

|

14/05/2024

|

|

18/03/2024

|

16/05/2024

|

21/05/2024

|

|

25/03/2024

|

23/05/2024

|

28/05/2024

|

|

1/04/2024

|

30/05/2024

|

4/06/2024

|

|

8/04/2024

|

6/06/2024

|

11/06/2024

|

|

15/04/2024

|

13/06/2024

|

18/06/2024

|

|

22/04/2024

|

20/06/2024

|

25/06/2024

|

|

29/04/2024

|

27/06/2024

|

2/07/2024

|

|

6/05/2024

|

4/07/2024

|

9/07/2024

|

|

13/05/2024

|

11/07/2024

|

16/07/2024

|

|

20/05/2024

|

18/07/2024

|

23/07/2024

|

|

27/05/2024

|

25/07/2024

|

30/07/2024

|

|

3/06/2024

|

1/08/2024

|

6/08/2024

|

|

10/06/2024

|

8/08/2024

|

13/08/2024

|

|

17/06/2024

|

15/08/2024

|

20/08/2024

|

|

24/06/2024

|

22/08/2024

|

27/08/2024

|

17. Resolves to add the following penalties to

unpaid rates:

a. for the excess water supply commercial

volumetric targeted rate, and the excess water supply residential volumetric

targeted rate, a penalty of 10 per cent will be added to any portion of an

invoiced amount not paid on or by the due date, to be added on the date shown

in the "Penalty date" column in the table above, based on the week in

which amounts are invoiced;

b. for all rates except the excess water supply

commercial volumetric targeted rate, and the excess water supply residential

volumetric targeted rate, a penalty of 10 per cent will be added to any portion

of an instalment not paid on or by the due date, to be added on the following

dates:

|

Instalment

|

1

|

2

|

3

|

4

|

|

Area 1

|

18 August

2023

|

21 November

2023

|

20 February

2024

|

20 May 2024

|

|

Area 2

|

20

September 2023

|

20 December

2023

|

20 March

2024

|

20 June

2024

|

|

Area 3

|

5 September

2023

|

5 December

2023

|

4 March

2024

|

6 June 2024

|

c. for all rates, an additional penalty of 10 per

cent will be added on 1 October 2023 to any rates assessed, and any penalties

added, before 1 July 2023 and which remain unpaid on 1 October 2023;

d. for all rates, a further penalty of 10 per

cent will be added if any rates to which a penalty has been added under (c)

above remain unpaid on 1 April 2024.

3. Reason for Report Recommendations Ngā Take mō te

Whakatau

3.1 All

Councils in New Zealand are required to have an approved Long Term Plan in

place at all times, or an LTP updated by an Annual Plan.

3.2 This

Annual Plan was prepared after extensive consultation with our community as

well as briefings with Council – see section 6 ‘Background’

for details.

4. Alternative Options Considered Ētahi atu Kōwhiringa

4.1 N/A.

5. Detail Te Whakamahuki

5.1 The Council is required to prepare and adopt an Annual Plan for each

financial year (s.95(1)) Local Government Act 2002).

5.2 The decision affects the following wards/Community Board areas:

5.2.1 All

wards and Community Board areas.

6. Background

6.1 The Long-term Plan

(LTP) 2021-31 was approved by Council in June 2021. It followed a comprehensive

process that reviewed operational expenditure, levels of service and the

capital programme in a highly detailed way.

6.2 The

Council is required to prepare and adopt an Annual Plan for each financial year

(s.95(1)) Local Government Act 2002).

6.3 The

purpose of the plan is to:

6.3.1 contain

the proposed annual budget and funding impact statement for 2023/24;

6.3.2 identify

any variation from the financial statements and funding impact statement in the

Council’s Long Term Plan for 2023/24;

6.3.3 provide

integrated decision-making and co-ordination of the Council’s resources;

and contribute to the accountability of the Council to the community.

6.4 The

information for the Annual Plan 2023/24 has been prepared in accordance with

the requirements of the LGA 2002. The information includes:

6.4.1 the

proposed annual budget and funding impact statement for 2023/24;

6.4.2 any

variation from the financial statements and funding impact statement included

in the Council's 2021-2031 Long Term Plan for 2023/24;

6.4.3 proposed

changes to the Council's capital programme for 2023/24 and any changes to the

Level of Service provision for activities undertaken by the Council;

6.5 The

draft Annual Plan 2023/24 was adopted by the Council on 28 February 2023.

6.6 The

Council completed consultation with the community on the draft Annual Plan

2023/24 via a Consultation document and underlying information adopted on 28

February 2023.

6.7 The

Consultation document and the underlying information were made publicly

available and members of the public were given the opportunity to present their

views and preferences in response;

6.7.1 Opportunity

for members of the public to present at public hearings was available from 27

April to 4 May 2023;

6.7.2 All

submissions, written and oral, have been analysed to identify the matters

commented on, the reasons for those comments and the overall themes that

emerged from the consultation process.

6.8 The

result of this work has been provided to elected members to assist with their

deliberations. The Thematic Analysis of the Annual Plan 2023/24 Submissions is Attachment

E of this report.

6.9 In

the time since the conclusion of the Hearings staff have held numerous

briefings with councillors (15, 24, 30 May, 1 and 6 June 2023), provided

responses to issues and questions raised, and received direction on all matters

raised. The briefing of 1 June was open to the public.

6.10 Guidance

provided by Elected Members and the Mayor’s Recommendations has been

built into the Annual Plan 2023/24 adoption documents, including expectations

for rates increases.

6.11 Changes

made largely reflect community feedback on the Draft Annual Plan or changes to

Council’s operating environment since February.

6.12 Having

obtained specific guidance from councillors, staff prepared a report and

attachments for the Annual Plan 2023/24. The process for preparing information

has been the subject of a detailed series of staff sign offs that demonstrate

compliance with the Council’s statutory, financial, and legal

obligations.

6.13 These

signoffs (both management process and for significant assumptions used in the

Annual Plan) have been reviewed by the Audit and Risk Management Committee. In

the opinion of the Committee an appropriate process has been followed in the

preparation of this information.

6.14 In

response to questions from councillors, staff have provided a wide range of

advice and recommendations. Some are not Annual Plan recommendations per se (as

they are processes or actions, not budget line items) but those with councillor

support will be tracked as action items and their implementation reported back

to Council.

7. Financial Overview

Rates

7.1 The

recommended Annual Plan includes a rates requirement (excl. GST) to be levied

of $679.2 million.

7.2 The

proposed average rates increase to all existing ratepayers of 6.33% is higher

than the 5.42% forecast in the 2021-31 Long Term Plan and higher than the 5.68%

proposed in the Draft Annual Plan. The average house will have a rates increase

of $3.97 per week.

7.3 The

increases for the average capital value property in the 3 sectors is:

Residential 6.52%

Business 5.61%

Remote Rural -0.60%

7.4 The

material drop in the Remote Rural average from 0.69% in the Draft is largely

due to a reduced general rate requirement of $5.6 million.

Operating Expenditure

7.5 Operational

expenditure of $605.8 million is $20.6 million above the level forecast in the

draft Annual Plan principally due to:

7.5.1 Additional

projects funded from the Crowns Better Off funding package ($7.6 million),

7.5.2 Water

Supply chlorination and other operational and maintenance costs ($4.9 million),

7.5.3 Personnel

costs ($4.6 million),

7.5.4 Costs

relating to the living wage announcement ($3.9 million), and other notified

contract increases ($0.6 million),

7.5.5 Lower

Consenting costs reflecting forecast volume reduction ($1.4 million).

7.6 Interest

costs are $4.7 million higher than projected in the Draft Annual Plan largely

due to updated interest rates relating to onlending to subsidiaries which is

recovered ($2.6 million), the retiming of Te Kaha borrowing ($2.6 million), and

a reduction from reassessing the projected opening debt position ($1

million).

7.7 Details

of all changes are shown in Attachment B, Financial changes from the

Draft Annual Plan.

Revenue

7.8 Total

revenue excluding rates of $479.9 million is $20.3 million higher than that

included in the Draft Annual Plan. The main revenue changes are:

7.8.1 Additional

Crown project funding ($10.5 million) substantially related to the Better Off

funding package,

7.8.2 Additional

subvention receipts available ($10 million),

7.8.3 Higher

interest revenues of $3.4 million, due to increased interest rates and higher

opening onlending to CCHL,

7.8.4 Additional

Waka Kotahi operational revenue mainly from CERF projects ($1.2 million),

Partially

offset by,

7.8.5 Lower

Waka Kotahi capital revenues ($3.2 million),

7.8.6 Reduced

commercial excess water and trade waste revenue ($1.9 million),

7.8.7 Lower

forecast consenting volumes ($1.7 million).

Surplus, operating

deficits, and sustainability

7.9 The

recommended Annual Plan for 2023/24 shows an accounting surplus of $118.1 million

before revaluations. Under accounting standards the Council is required to show

all revenue, including recoveries from central Government and NZ Transport

Agency, as income for the year. However, some of these recoveries reimburse the

Council for capital expenditure. After adjusting for these capital revenues,

the Council is forecasting a balanced budget for 2023/24.

Capital programme expenditure

7.10 The capital programme has been

reviewed with heavy focus on deliverability, to ensure ratepayers are not

levied in advance of funds being required. Details of proposed changes from

Draft Annual Plan 2023/24 are shown in Attachment C. Key factors taken

into account when considering deliverability were:

· Labour demands and resultant shortages (internal

and external),

· Ongoing supply chain issues,

· Cost escalation pressures.

7.11 The Council plans to invest a total

of $746.4 million in the capital programme in 2023/24, an increase of $130.5

million from the Draft Annual Plan.

7.12 Increased spend planned in 2023/24

compared to the Draft Annual Plan includes the following (refer Attachment C

for the full list):

· Revised timing of spend on

Te Kaha (+$127.0 million),

· Additional Council funding

to support the changes for the Coastal Pathway (+$1.4 million),

· Rephasing of Akaroa Wharf

Redevelopment to reflect design, consenting and procurement (-$4.3 million),

· Rephasing of the

Canterbury Provincial Chambers Stage 1 allowance (-$1.5 million),

· The Grassmere Housing

Development Infrastructure Acceleration Funding from Central Government (total

$30.9million) requires a net positive investment in horizontal infrastructure

(+$1.8million),

· The Better Off Funding

from Central Government (total $11.75 million for capital expenditure over 4

years) provides investment in Parks and Community (+$0.9million).

· Revised timing of spend on

Matatiki: Hornby Community Centre reflecting good progress (+$4.6 million).

This includes funding of $450,000 from Better Off Funding Initiative provided

by Central Government,

· The Tsunami Warning System

is rephased to provide time to continue to work on the technical solution

before implementation (-$0.7 million),

· The Takapūneke

Reserve has been allocated additional funds (+$0.5 million).

7.13 Other

key changes from the Draft Annual Plan that do not impact 2023/24 include

change requests and drawdowns completed under staff delegations and reported to

Council on a quarterly basis. These have a net zero impact on 2023/24.

Capital programme

funding

7.14 The

capital programme is funded by subsidies and grants for capital expenditure,

development contributions, proceeds from asset sales, rates and debt. In

2023/24 we will rate for $192.7 million of renewals which is consistent with

our Financial Strategy.

Borrowing

7.15 The

recommended Annual Plan includes net new borrowing in 2023/24 of $293.9

million, an increase of $114.9 million from the Draft Annual Plan, reflecting

the advanced spend timing in relation to Te Kaha. Gross debt at 30 June 2023 is

expected to be $2.66 billion, $125 million higher than the Draft Annual Plan

due to Te Kaha.

7.16 In

accordance with our financial strategy we will continue to ensure prudent and

sustainable financial management of our operations and will not borrow beyond

our ability to service and repay that borrowing.

8. Significant Assumptions

8.1 Significant

assumptions were reviewed and there is no significant change from the Draft

Annual Plan. A number have been rewritten for improved clarity of risk.

9. Financial Risk Management Strategy

9.1 The

Council’s policies to assist in managing its financial risk, including

liquidity and funding risk management, interest rate exposure and counterparty

credit risk are unchanged. An important element in assessing the value of the Council’s

risk management strategy is its five key financial ratios (two net debt, two

interest and one liquidity). These key ratios are all expected to be met in

2023/24.

9.2 The

two Financial Prudence benchmarks not expected to be met in the Draft Annual

Plan remain so. They are the Rates Affordability benchmark and the Debt

Servicing benchmark.

9.3 The

Rates Affordability benchmark measures the notional year on year increase in

rates. For 2023/24 it is 8.4%, up from 7.8% in the Draft, and compared to the

LTP benchmark of 7.2% (which was based on the projected LTP notional increase

of 6.2% plus 1% variation). Significantly higher inflation and interest costs

compared to the 2.3% inflation and 2.4% new borrowing cost incorporated in the

LTP have largely caused the higher increase.

9.4 The

Debt Servicing benchmark (borrowing costs as a percentage of revenue being less

than 10%) is not forecast to be met for 2023/24. It is forecast at 11.2%,

resulting from significant increases in interest rates since February 2022 and

additional borrowing for on-lending to subsidiaries. In the LTP this benchmark

was expected to be breached in 2026/27 – 2028/29. Approximately one third

of the interest cost relates to on-lending to subsidiaries which generates offsetting

interest revenue that the ratio doesn’t consider. Without this cost the

ratio is well below the 10% benchmark. There is no concern around the ability

to service the debt.

10. Fees and Charges

10.1 There

are a number of minor wording corrections/clarifications from the Draft Annual

Plan schedule.

11. Changes to Levels of Service

11.1 There

are no additional changes to levels of service other than those adopted with

the Draft Annual Plan 2023/24.

12. Annual Plan Process

12.1 The

Council is required to prepare and adopt an Annual Plan for each financial year

(s.95(1)) Local Government Act 2002).

12.2 The

purpose of the plan is to:

12.2.1 contain the

proposed annual budget and funding impact statement for 2023/24;

12.2.2 identify any

variation from the financial statements and funding impact statement in the

Council’s Long Term Plan for the financial year 2023/24;

12.2.3 provide

integrated decision-making and co-ordination of the Council’s resources;

and contribute to the accountability of the Council to the community.

12.3 The

information for the Annual Plan 2023/24 has been prepared in accordance with

the requirements of the LGA 2002. The information includes:

12.3.1 the proposed

annual budget and funding impact statement for 2023/24;

12.3.2 any variation

from the financial statements and funding impact statement included in the

Council's 2021-2031 Long Term Plan for 2023/24;

12.3.3 proposed

changes to the Council's capital programme for 2023/24 and any changes to the

Level of Service provision for activities undertaken by the Council;

12.3.4 revised

schedule of significant assumptions.

12.4 The

information has been prepared in accordance with the principles and procedures

that apply to the preparation of the financial statements and funding impact

statement included in the 2021-2031 Long Term Plan. It contains appropriate

references to the provisions in the LTP which set out the Council's activities

for the 2023/24 financial year.

12.5 The

information also complies with the requirements set out in Part 2 of Schedule

10 of the LGA 2002 in respect of the information to be included in an Annual

Plan.

12.6 Following

adoption, the final Annual Plan document will be published and distributed via

the public web site, with a select number of hard copies made available to

elected members, for public viewing through our libraries and service centres,

and to the Parliamentary Library. Responses to submitters will be prepared and

sent, and the responses to submissions and Thematic Analysis will be also

published to the public site.

13. Consultation

13.1 The

draft Annual Plan 2023/24 was adopted by the Council on 28 February 2023.

13.2 The

Council completed consultation with the community on the draft Annual Plan

2023/24 via a Consultation document and underlying information adopted on 28

February 2023.

13.2.1 The

Consultation document and the underlying information were made publicly

available and members of the public were given the opportunity to present their

views and preferences in response;

13.2.2 Opportunity for

members of the public to present at public hearings was available from 27 April

to 4 May 2023. We received 811 submissions and 115 submitters appeared in

person;

13.2.3 All

submissions, written and oral, have been analysed to identify the matters commented

on, the reasons for those comments and the overall themes that emerged from the

consultation process;

13.2.4 The result of this work has been provided to elected members

to assist with their deliberations. The Thematic Analysis of the Annual Plan 2023/24

Submissions is Attachment E of this report. The Thematic Analysis

provides a summary of key issues identified by a significant number of

submitters. The first part of the report provides an overview of the key themes

and messages that have come through in submissions (including for four special

topic consultations that were run in parallel with the Annual Plan). The latter

part of the report provides detailed submissions analysis for some of the

issues that were most popular with submitters. Also included is a breakdown of

the number of submissions received, by Community Board, age and gender.

13.3 In

the time since the conclusion of the Hearings staff have held numerous

briefings with councillors (15, 24, 30 May, 1 and 6 June 2023), provided

responses to issues and questions raised, and received direction on all matters

raised. The briefing of 1 June was open to the public.

13.4 Guidance

provided by Elected Members and the Mayor’s Recommendations has been

built into the Annual Plan 2023/24 adoption documents, incorporating any rates

impact.

13.5 Changes

made largely reflect community feedback on the draft Annual Plan or changes to

Council’s operating environment since adopting the draft in February.

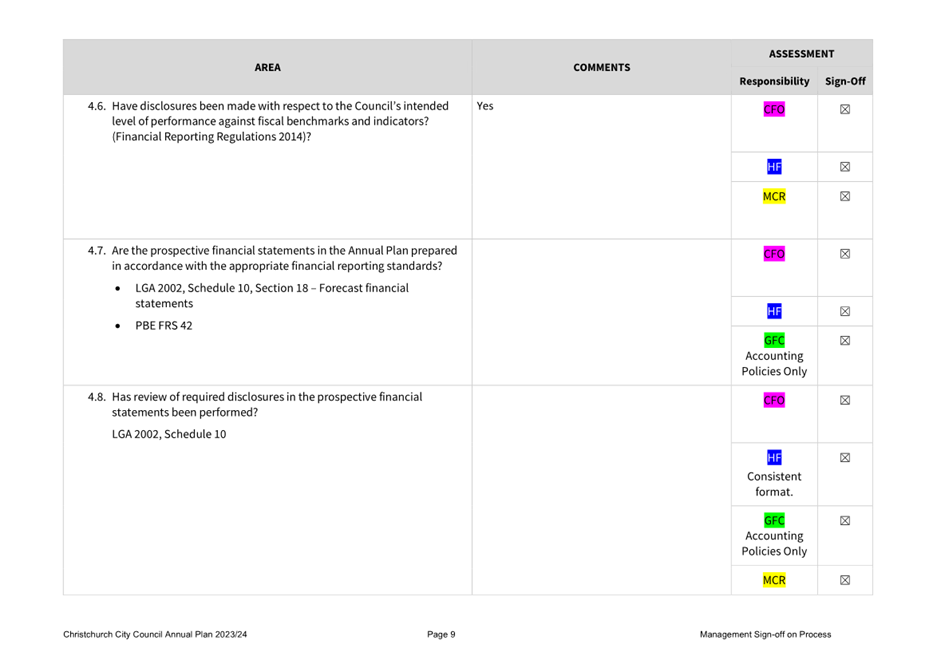

14. Audit and Risk Management Committee

14.1 Council’s

Audit and Risk Management Committee met on 20 June 2023 in respect of the

information that provides the basis for the 2023/24 Annual Plan. The Committee

resolved the following:

That the Audit and Risk Management

Committee:

1. Notes

it has reviewed the general checklist and sign-off by management, including

significant forecasting assumptions, in respect of the information that

provides the basis for the Annual Plan 2023/24.

2.

Advises the Council that in the Committee’s opinion an appropriate

process has been followed in the preparation of this information.

15. External Audit

15.1 Note

that Annual Plans are not

subject to formal audit by

Audit New Zealand.

16. Policy

Framework Implications Ngā

Hīraunga ā- Kaupapa here

Strategic

AlignmentTe Rautaki

Tīaroaro

16.1 This

report supports the Council's

Long Term Plan (2021 - 2031):

16.2 Internal Activities

16.2.1 Activity: Performance Management and Reporting

· Level of Service: 13.1.1 Implement the Long Term

Plan and Annual Plan programme plan - Critical path milestone due dates in

programme plans are met.

Policy

Consistency Te Whai

Kaupapa here

16.3 The decisions are

consistent with Council’s Plans and Policies.

Impact

on Mana Whenua Ngā

Whai Take Mana Whenua

16.4 The annual plan

involves a significant decision in relation to ancestral land or a body of

water or other elements of intrinsic value, in that Takapūneke Reserve will

receive additional funds.

16.5 The purpose of the

Annual Plan is to update specific content from the last Long Term Plan,

especially where circumstances have changed. It is not a fundamental review of

plans.

16.6 The Long Term Plan

2021 contained a range of services and initiatives whose purpose was to involve

and support Mana Whenua in the future planning, direction and development of

the city. That relationship must be extended and built upon as a

partnership during the development of the 2024-34 Long Term Plan.

16.7 New processes are

already in train to ensure that our partnership priorities are met for the 2024

LTP. This includes the appointment of new Te Tiriti Relations advisors, and

ongoing discussions and relationship-building with Mana Whenua

representatives. Discussion with the Te Tiriti Relations advisors as part

of this process indicated their preference to focus on co-development of the

Strategic Framework and 2024 LTP rather than the details of the Annual Plan

2023/24.

16.8 The LTP process

specifically includes early involvement of Mana Whenua in both the setting of

Strategic Framework that will drive the next LTP, and in the detailed planning

phases that occur (around services, projects and processes) before a draft LTP

is developed. These are new processes and are still being developed and

refined.

16.9 The Council

directly engages with iwi – Te Rūnanga o Ngāi Tahu, and six of

the Papatipu Rūnanga who fall within the Council catchment as mana whenua

of respective rohe: Te Ngāi Tūāhuriri Rūnanga, Te Hapū

o Ngāti Wheke, Wairewa Rūnanga, Te Rūnanga o Koukourārata,

Ōnuku Rūnanga and Te Taumutu Rūnanga.

Climate

Change Impact Considerations Ngā Whai Whakaaro mā te Āhuarangi

16.10 This Annual Plan continues

with the climate change commitments set out in the 2021 Long Term Plan and sets

the stage for further initiatives in the 2024 LTP.

Accessibility

Considerations Ngā

Whai Whakaaro mā te Hunga Hauā

16.11 Not relevant.

17. Resource Implications Ngā Hīraunga Rauemi

Capex/Opex Ngā Utu Whakahaere

17.1 Cost

to Implement - within existing budget.

17.2 Maintenance/Ongoing

costs - within existing budget.

17.3 Funding

Source - existing budget per Council's Long Term Plan (2021 – 2031.)

Other He mea anō

17.4 None.

18. Legal Implications Ngā Hīraunga ā-Ture

Statutory power to undertake proposals in the report

Te Manatū Whakahaere Kaupapa

18.1 The Council is required to prepare and adopt a Draft Annual

Plan for each financial year (s.95(1)) Local Government Act 2002).

Other Legal Implications Ētahi atu

Hīraunga-ā-Ture

18.2 There is no additional legal context, issue or

implication relevant to this decision.

19. Risk Management Implications Ngā Hīraunga Tūraru

19.1 Risks

identified and managed through the general checklists and sign-offs by

management, including significant forecasting assumptions, reviewed by Audit

and Risk Management Committee.

Attachments Ngā Tāpirihanga

|

No.

|

Title

|

Reference

|

Page

|

|

a ⇩

|

Mayor's

Commentary and Recommendations

|

23/939657

|

20

|

|

b ⇩

|

Financial

changes from the Draft Annual Plan

|

23/976468

|

28

|

|

c ⇩

|

Proposed

changes to the Council's capital programme

|

23/929940

|

30

|

|

d ⇩

|

Funding Impact

Statement - Rating Information

|

23/946364

|

31

|

|

e ⇩

|

Thematic

Analysis of the Annual Plan 2023/24 Submissions

|

23/870042

|

47

|

|

f ⇩

|

Annual Plan

2023/24 - Management Sign-off for Process

|

23/902867

|

69

|

|

g ⇩

|

Annual Plan

2023/24 - Management Sign-off for Significant Forecasting Assumptions

|

23/902871

|

85

|

In addition to the attached documents, the following background

information is available:

|

Document

Name – Location / File Link

|

Confirmation of Statutory

Compliance Te Whakatūturutanga ā-Ture

|

Compliance with Statutory Decision-making

Requirements (ss 76 - 81 Local Government Act 2002).

(a) This report contains:

(i) sufficient information about all reasonably practicable

options identified and assessed in terms of their advantages and

disadvantages; and

(ii) adequate consideration of the views and preferences of

affected and interested persons bearing in mind any proposed or previous

community engagement.

(b) The information reflects the level of significance of the

matters covered by the report, as determined in accordance with the Council's

significance and engagement policy.

|

Signatories Ngā Kaiwaitohu

|

Authors

|

Boyd Kedzlie -

Senior Business Analyst

Adelaine

Hansson - Performance Analyst

Bruce Moher -

Manager Corporate Reporting

Andrew

Jefferies - Manager Rates Revenue

Andrew

Robinson - Head of Programme Management Office

Peter Ryan -

Head of Corporate Planning & Performance

Ron Lemm -

Manager Legal Service Delivery, Regulatory & Litigation

|

|

Approved By

|

Peter Ryan -

Head of Corporate Planning & Performance

Russell Holden

- Head of Finance

Helen White -

Head of Legal & Democratic Services

Leah Scales -

General Manager Resources/Chief Financial Officer

Lynn

McClelland - Assistant Chief Executive Strategic Policy and Performance

Dawn Baxendale

- Chief Executive

|